A 20% cut in our paychecks will definitely leave us crying for help!

Our banking sector endured a bumpy ride last year – with low earnings and massive bad debt allowances due to the downturn in the oil and gas sector. And in times like these, it’s not surprising that top executives have to take big hits to their remuneration.

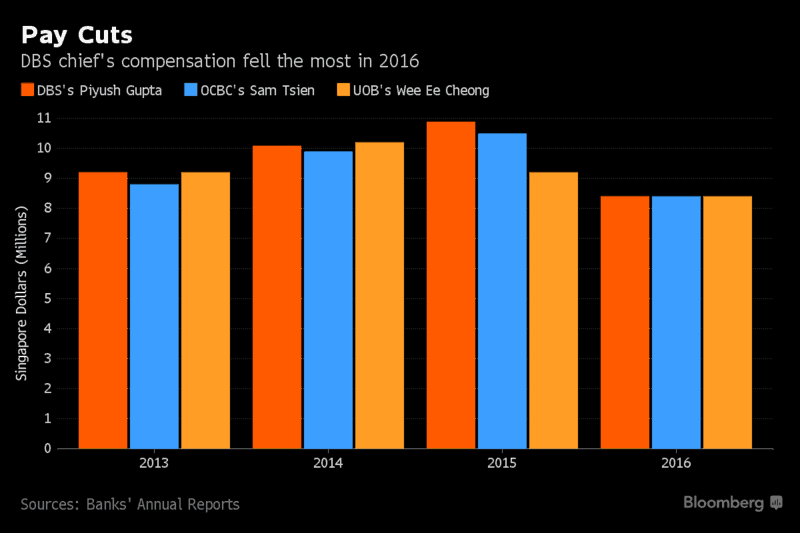

News of the chief executives of our local banks taking a pay cut has been circling around, and we’ve rounded up the pay cuts of the CEOs of our top 3 local banks.

A CEO’s annual remuneration usually comprises their basic salary, bonuses and various other rewards like equity and shares. While some volunteered for these less generous pay cuts, others not so much.

DBS, Piyush Gupta

He was the highest paid CEO before the cut and remains so. His total remuneration was $8.44 million last year, earning an estimated $700k per month. The package also included his bonus, which came down from $4.12 million to $3.12 million in 2016.

He suffered the most, with a 23% pay cut, compared to his counterparts at our two other large banks. DBS’s loans in the energy-support sector caused them to miss their 12% return-on-equity target for 2016 – which was one of the bank’s key performance indicators.

UOB, Wee Ee Cheong

Likewise, the struggling oil and gas sector was the main culprit the bank reported a 3.5% drop in full-year earnings to $3.1 billion. Its total exposure to the oil and gas sector amounted to $17.7 billion, the highest among the 3 banks. With the slow economic growth and challenging financial sector in the past 2 years, his annual remuneration has also fallen, for two years in a row.

Mr Wee’s total pay in 2016 was $8.422 million, down from $9.223 million in 2015. This was in turn lower than the $10.22 million he made in 2014, when he was the highest paid CEO of the local banks.

While his base salary actually remained unchanged at $1.2 million, he received smaller bonuses and fewer benefits in 2016 compared to 2015, according to their annual report they released in March this year.

OCBC, Samuel Tsien

Mr Samuel Tsien took a 20% pay cut to $8.3 million from S$10.5 million in 2015. The lower pay came mainly from a smaller cash bonus of S4.3 million, down from S$5.5 million previously. His base salary of S$1.2 million was unchanged.

At OCBC, Mr Samuel Tsien’s total remuneration was $8.38 million, down from $10.49 million a year earlier as his bonus dropped from $5.51 million to $4.25 million.

OCBC posted a net profit of $3.5 billion, down from 11 percent for 2106, due to higher non-performing loans – like every one of its counterparts.

While their 20-23 % pay cut is seemingly low – seeing how their monthly salaries are already more than what the average Singaporean probably earns in 2 years, it’s one tough balancing act. It’s probably a good idea to watch our backs next – since a 20% cut in our paychecks will definitely leave us crying for help.